Are you feeling lost when How to write a check for 1000 dollars? Don’t worry, you’re not alone. Many people need help writing a check, especially for a significant amount like 1000 dollars.

But fear not because this blog post is your ultimate guide to mastering the art of How to write a check for 1000 dollars. You can confidently fill out a check and pay without hesitation in just a few simple steps. So, let’s dive in and learn how to write a check for 1000 dollars!

- What is a Check?

- How to Write a Check For 1000 Dollars

- Related: How To Write A Check For 803 Dollars – Check Matter

- How to Write a Check for 1000 Dollars with Cents

- What To Do After Writing a Check For 00

- Why Would You Need to Write a Check?

- Is It Safe to Use Checks?

- Can I Write Check from Savings Account

- Can the Bank Write a Check for Me?

- Can I Write a Check for Myself?

- Can I Write a Check with Red Ink?

- What is the memo line used for?

- Understanding the Basics of a Check

- Related: How to Write a Check for 20 Dollars _ Everything You Need To Know

- Filling Out the Date Correctly

- How to Write the Amount in Numbers

- How to Write the Amount in Words

- Frequently Asked Questions

- Conclusion

What is a Check?

In the realm of financial transactions, a check is a potent tool. It’s a document, usually rectangular, issued by a bank. This small piece of paper holds significant weight, allowing individuals to transfer money from one account to another quickly.

It tells them to pay a specified amount from your account to the person or entity named on the check. Each check has a unique number, which is crucial for record-keeping and tracking transactions. Also, a check provides a legal trail and can be a safer alternative to carrying large amounts of cash.

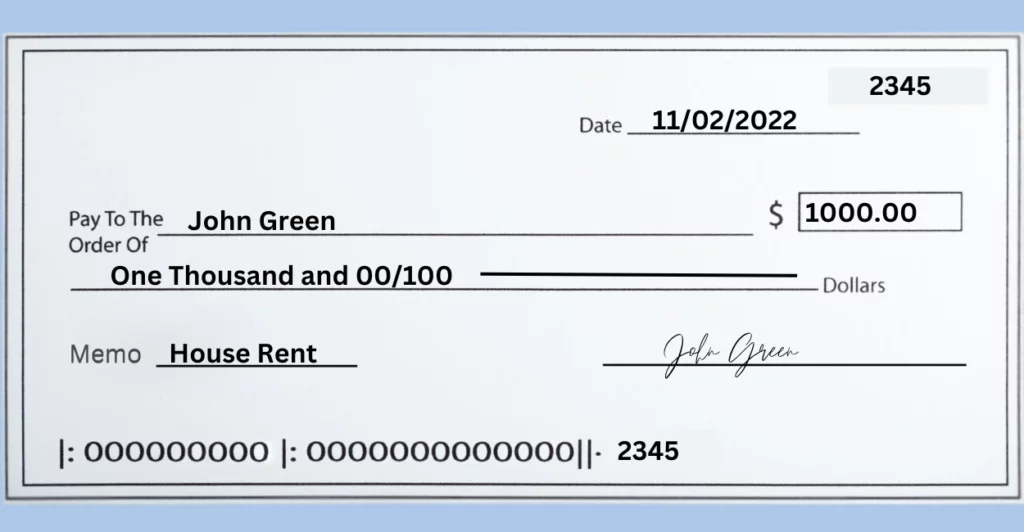

How to Write a Check For 1000 Dollars

How to write a check for 1000 dollars may seem daunting, but don’t fret. It’s a straightforward process. Here’s your step-by-step guide:

- Grab your checkbook and select a check. Make sure it’s clean and free from any markings.

- Date the check. Write the current date in the top right corner.

- On the “Pay to the Order of” line, write the name of the person or organization receiving the check.

- In the box next to the dollar sign, write “1000.00”. This signifies the check amount in numbers.

- Under the “Pay to the Order of” line, write “One Thousand and 00/100”. This is the check amount in words. Ensure there’s no room for additional numbers or words to prevent fraud.

- Sign the check on the designated line in the bottom right corner.

- Use the memo line to note what the check is for if needed.

Accuracy is critical to prevent errors or confusion. Happy check writing!

Related: How To Write A Check For 803 Dollars – Check Matter

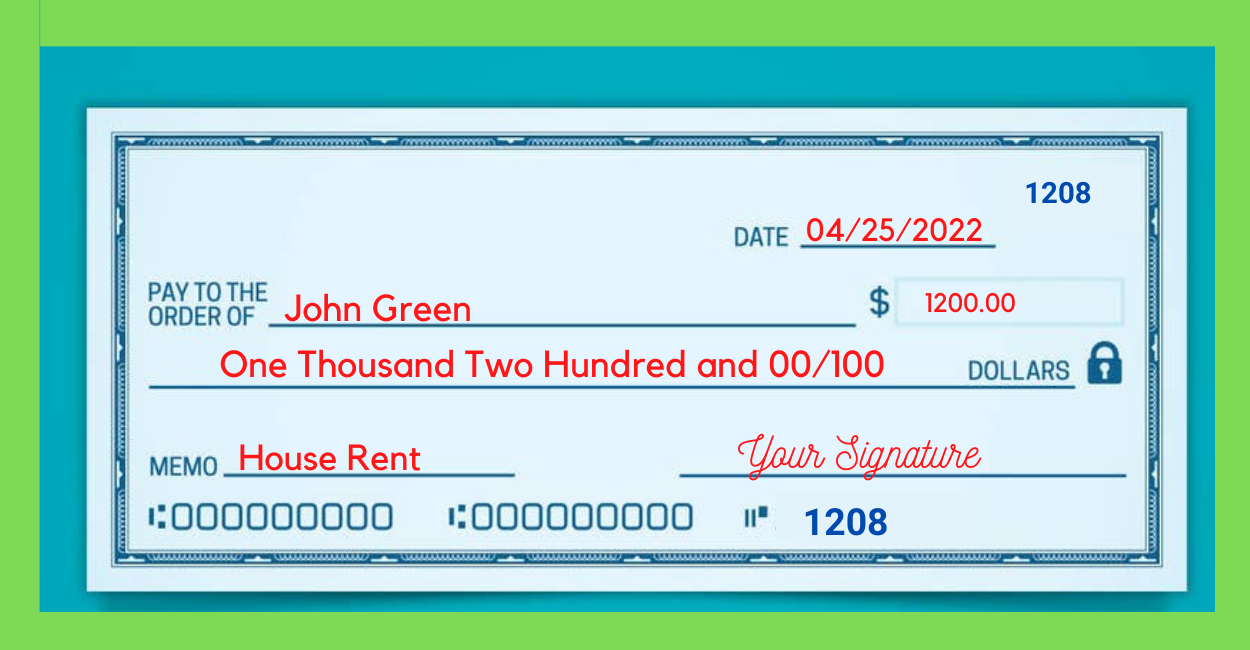

How to Write a Check for 1000 Dollars with Cents

How to write a check for 1000 dollars with cents follows a similar process as without. However, there is a slight difference in writing the amount in words. Here’s how to do it:

- Pull out your checkbook, select a pristine check, and grab a pen.

- Inscribe today’s date in the top right corner.

- Pen the recipient’s name on the “Pay to the Order of” line.

- Besides the dollar symbol, jot down “1000.50,” indicating the amount in numerals.

- In the following line under “Pay to the Order of,” inscribe “One Thousand and 50/100”, showing the amount in words.

- Ensure that you fill the line to deter any fraudulent alterations.

- Endorse the check by signing at the designated spot at the bottom right.

- The memo line is optional and can be used to explain the purpose of the payment. Now, you’ve

I have successfully written a check for 1000 dollars with 50 cents. Keep up the great work!

What To Do After Writing a Check For 00

You’re almost done once you know How to write a check for 1000 dollars. Here’s what to do next:

- First, double-check everything. Make sure the amount in numbers matches the amount in words.

- Cross-check the recipient’s name for accuracy.

- Make sure the date is correct.

- Confirm you’ve signed the check. An unsigned check is as good as an invalid!

- Now, it’s record time! Jot down the check number, date, recipient, and amount in your register. This record-keeping aids in tracking your spending.

- Finally, gently detach the check from your checkbook, ensuring it remains intact.

- Fold it carefully, place it in an envelope if you’d like, and you’re ready to deliver your check!

Remember, careful handling is essential to avoid damaging your check.

Why Would You Need to Write a Check?

There are many scenarios where you might need to write a check. For instance, you may need to pay rent, settle a bill, or donate to a charity. These entities often prefer checks due to their traceability, especially for large sums like 1000 dollars. If you run a small business, write checks to pay employees or vendors.

Even in this digital age, checks can come in handy when other forms of payment are not acceptable or convenient. Plus, if you’re dealing with a skeptical recipient, a check assures the funds are available, creating a sense of security. Ultimately, the need to write a check depends on your unique circumstances and preferences.

Is It Safe to Use Checks?

Absolutely! Checks can be a safe and secure method of payment. They have multiple security features embedded, such as microprinting and watermarks, making them hard to counterfeit. Unlike cash, if a check is lost or stolen, it can be stopped and reissued.

However, it’s crucial to write checks carefully. Always fill in all the details, including the amount and recipient name, to prevent fraudulent alterations. Also, handle your checkbook responsibly, storing it safely and securely.

Can I Write Check from Savings Account

Can you write a check from your savings account?? The answer, quite simply, is no. Traditional savings accounts don’t come with check-writing privileges. Why so? Well, savings accounts are primarily designed for saving, not transactions.

So, while a savings account is a fantastic tool for stashing away funds, it doesn’t provide the transactional convenience a checking account does. You’ll want to use a checking account structured for regular transactions, including writing checks if you need to write a check.

Can the Bank Write a Check for Me?

Yes, indeed! Banks can assist you in writing checks. This service is often known as a cashier’s check or bank draft. If you’re uncomfortable writing an extensive check amount or the recipient requires a more secure form of payment, this can be a great option.

Because their bank’s resources back it, cashier’s checks are highly reliable. However, this service often comes with a fee, which varies among banks. It’s also important to note that the recipient’s name is needed at issuance, as cashier’s checks are difficult to cancel.

Can I Write a Check for Myself?

Yes, you can! Writing a check to yourself is a savvy way to move money securely between your accounts. Think of it as a free paper wire transfer! Say you’ve two accounts: Checking in Bank A and Savings in Bank B. You need to transfer funds from A to B.

Write a check to yourself, just as you would for someone else. Your name goes on the “Pay to the Order of” line. Once written, you can deposit it into your other account. A word of caution: always ensure sufficient funds in the account to cover the check. If not, you might face fees for insufficient funds. Happy self-check writing!

Can I Write a Check with Red Ink?

You can technically write a check with red ink, but should you? The answer is a firm no—color matters when writing checks. Financial institutions prefer blue or black ink because machines easily recognize these colors for processing checks.

Some banks may even reject checks written in red ink to avoid errors. So, although that vibrant red pen might be calling your name, stick to the classic blue or black when penning checks. It’s not the time to show off your colorful pen collection!

What is the memo line used for?

Peek at your check. Do you see that line titled “Memo”? It’s not a mere decoration! This small space plays a pivotal role. While not mandatory, it provides valuable context. It’s the narrative of your financial story, a reminder of why you wrote the check. Paying rent? Write “April Rent”. Donating to charity? Pen “Donation”.

Reimbursing a friend? Scribe “Pizza Night”. It helps you and the recipient remember the check’s purpose, simplifying tracking and reconciling later. Moreover, this little line can be your silent witness in disputes or misunderstandings, validating payment intent. So, remember to fill out the memo line next time you write a check. It’s your check’s mini-diary, after all!

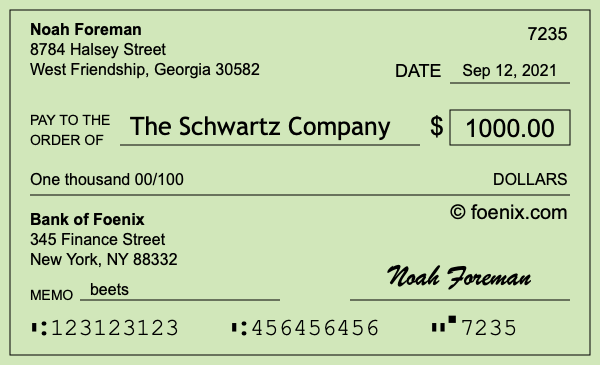

Understanding the Basics of a Check

Mastering the basics of a check is quite simple! Here are the main elements you’ll find on every check:

Your personal information:

The top left corner displays your name, address, and sometimes your phone number.

The check number:

Located in the top right, it’s essential for record keeping and prevents duplicate payments.

The payee line:

The “Pay to the Order of” line, where you write the recipient’s name.

The amount box:

You write the amount in numerals next to the dollar sign.

The amount line:

Beneath the payee line, you jot down the amount in words, making the payment clear and indisputable.

The memo line:

An optional space for noting the check’s purpose.

Your signature:

Your autograph at the bottom right authorizes the payment. With it, the check is valid.

Get these basics right, and you’re a check-writing pro!

Related: How to Write a Check for 20 Dollars _ Everything You Need To Know

Filling Out the Date Correctly

While writing a check, the date plays a crucial role. The process might seem simple, but you need to be meticulous. Let’s explore this further:

- First, locate the date line. You’ll find it in the top right corner of your check.

- Pen down the current date. Always use the current date unless you’re post-dating, which isn’t recommended.

- Format it right! In the US, the format is usually “Month Day, Year”. For example, “May 14, 2022”.

- No abbreviations, please. Write out the entire month’s name to avoid confusion. So, it’s “May”, not “5” or “05”.

- Be accurate and consistent. The wrong date can lead to delayed or denied payments.

Remember, the devil is in the details when filling out the date correctly on a check!

How to Write the Amount in Numbers

There’s an art to writing the amount in numbers on a check, and here’s your guide to mastering it:

- First, locate the small box on the right side of your check.

- This is your canvas to inscribe the amount in numbers. Ensure the figure matches the amount in words.

- Start writing from the far left of the box. Pen down “1000.00” if you’re issuing a thousand-dollar check. No commas are needed!

- For cents, use a decimal. So, $1000.50 should be written as “1000.50”, not “1000 50”.

- Keep it tight—no room for extra digits or decimal places.

- Avoid any alterations. Strikethroughs and overwrites can make the check void.

Embrace precision, and make every number count! Happy numbering!

How to Write the Amount in Words

Writing the amount in words on a check is an art. Here’s how you can get it right every time:

- The line beneath the “Pay to the Order of” space. This is where the magic happens.

- Start writing as far to the left as possible. This leaves less room for anyone to add extra digits.

- For $1000, write “One Thousand and 00/100”. The “and” represents the decimal point.

- If there are cents involved, let’s say 50 cents, write it as “One Thousand and 50/100”.

- Avoid fractions. Use “100” as the denominator.

- Remember to draw a line after the last word to the end of the space. This is your final guard against fraudulent additions.

Remember, clear and consistent handwriting is essential for check readability. Practice makes perfect, so keep at it!

Frequently Asked Questions

Did you make a mistake when writing your $1000 check?

No worries, write “VOID” across it and start a new one. Remember, don’t try to correct it, as this could lead to suspicions of tampering.

Can you write a $1000 check without sufficient funds?

Technically, yes. However, doing so can result in bounced checks, hefty fees, and potential damage to your banking history.

How long will it take for your $1000 check to clear?

Banks must make funds available within two business days, which can vary depending on your bank’s policies.

How do you spell $1000?

You write it as “One Thousand and 00/100” in the amount line of your check.

Are you writing a $1000 check to yourself?

It is pretty straightforward. In the “Pay to the Order of” line, simply write your name and fill out the check as usual. This is a clever way to move money between your accounts!

Conclusion

We’ve embarked on a check-writing journey together, demystifying the seemingly complicated task of writing a $1000 check. Along the way, we’ve delved into what a check is, its significance, and the steps to fill it out correctly. We explored common queries, such as writing a check to yourself, using red ink, and the implications of the memo line.

They’ve also learned about potential pitfalls and how to avoid them. Armed with this newfound knowledge, you can confidently pen that thousand-dollar check. Precision, accuracy, and security are your friends in this endeavor. So, pull out your checkbook and let your inner check-writing pro shine!

[…] This guide will explore the step-by-step process of writing a check. It ensures you have the knowledge and confidence to handle your financial transactions quickly and accurately. To pay for the repairs, I needed to learn how to write a check for 1000 dollars. […]

[…] to write a check for thirty dollars! While technology has made many financial transactions easier, writing a check is still an essential skill to have. Whether you’re paying rent, utilities or buying […]